15/07/2013

Trying something out.......Lets see how this goes!

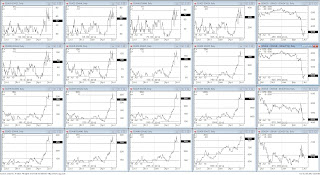

Bund found its way to 143.77 resitance area last week. Almost like Taper talk has never happened!

Bor curves pulled back enough, have started to steepen again. I fancy that the bond curves have flattened plenty, exaggereated by thin summer volume. I'm looking to put on steepeners now looking to fade any bund up moves toward 144.18 and 144.44ish.

In the U.S.

Not so much flight to quality bid last week compared to bund as it would appear that its Europe thats broken. I'll be looking at 126.00 downside break to lead to gap fill and test of 125.05 area.

I see the longer term steepening to continue and would look for 2s10s to offer the most value at present.

Fed Funds

Much as rate hikes are a couple of years away (I think) The Stir products are now in long term steepening tone. I think fade dips in spreads during poor data releases are the way forward.

Plenty of data out this week, so could be nice opportunities. Just keep you clip size small in keeping with the general volume going thru and you should be able to wear any over extended moves.

U.S. teds and ED/FF spread; I'll lay off any comments till I have my eye in fully....(likely to be while yet) But I will be playing the range in this rather than have a directional view at present.