Merkel and Draghi's fears being realised this morning as the people of Greece celebrate a Syriza general election win. I'm still not clear on whether this is outright or as a coalition.

After this bit is settled it'll be all eyes on the Troika, will there be a suspension of assistance? will all get around the table and discuss some kind of compromise? Will this Government's ideas be too unworkable that we see another election come April?

Only time will tell......Needless to say Bunds will carry on its march to 0 yield & curve to flatten, I'd also expect BTP to continues its compression vs bunds after its shaken off this brief Grexit fear.

TYA 240min

30min

Bund 240min

30min

€curve

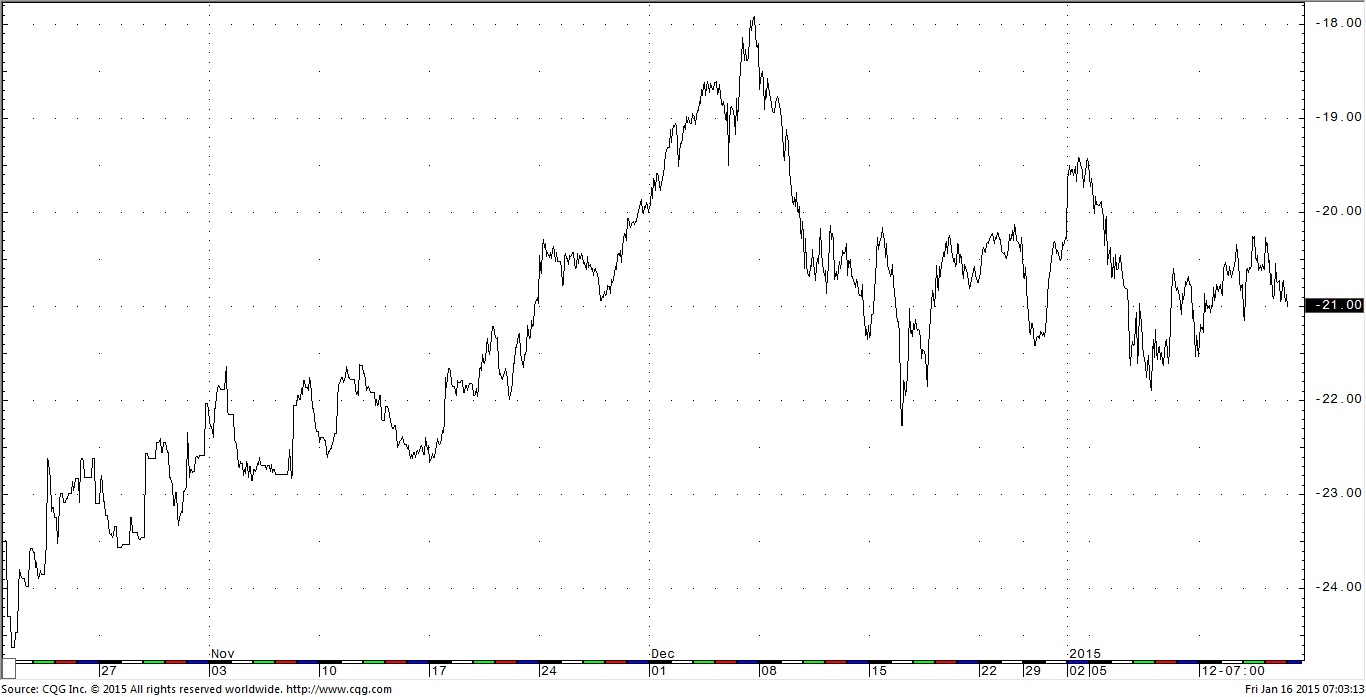

BTP-Bund

BTP 30min

€ ted

EURUSD future 240min

Stoxx Daily continuous

Mini Snp 240min

We have IFO and Euro retail sales this morning for what its worth. Then we can start looking towards the US for some rates of interest later in the week.