Good morning all,

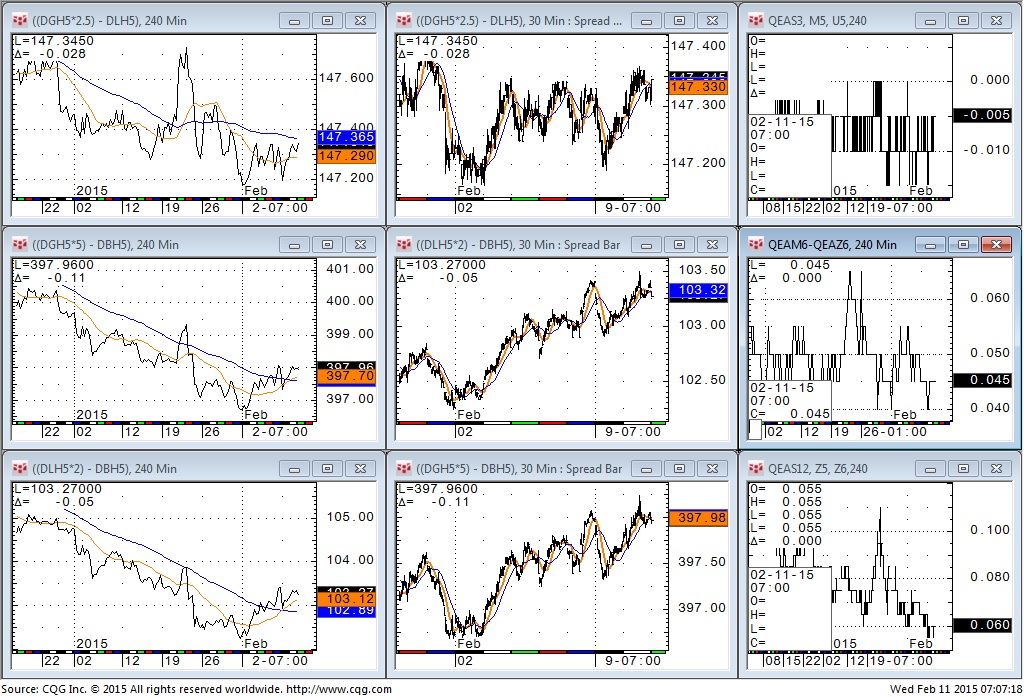

US stir/bond net change

EU stir/bond net change

Ten year 240min

Bund. Stories about the size of ECB purchases for bunds on QE program have encouraged some buying despite a more positive tone to the Greek situation and a "Ceasefire" in Ukraine.

All time high in the sights!

Stoxx....Just close your eyes and buy!

EU6, Shorts taking profits.

€ teds, Slightly better bid tone to the Euribor has seen teds firm up a little.

€ curve, In light of the ECB bond buying story we see the flattening continue after a test of upper trend line resistance.

European GDPs the Michigan this afternoon are the major data releases.

Be lucky

Lee

Friday 13 February 2015

Wednesday 11 February 2015

11/02/2015

Eurogroup meeting today trumps all other news. Schaeuble appears to be pissing on everybody's chips by suggesting that any idea of a quick fix/short term resolution are fantasy. I expect toing and froing of this kind all day from squawks before we get any announcements late on.

US stir/bond net changes for yesterday

In anticipation of the rumoured quick fix and moderately decent data we saw some steepening.

EU stir/bond net changes.

TY,

Bund. After managing to test the 158.32 and breaking we closed back in the middle of range, could be an interesting day. Mid term a down trend is beginning to appear. I still need to see 157.77 broken before I'm convinced of bearish trend in the long term. Intra day risk that yesterdays low break was a falsey and bad news from the Eurogroup could push us back to new high targets. We are in a corridor of uncertainty and anything between 40 and 80 is chop to be treated with caution and tight stops. At the mercy of tape bomb luck.

EU6

Stoxx

Btp-Bund I use as a leading indicator on teds......mildly optimistic looking.....Although QE will trump Grexit on this relationship(eventually)

Dec16 Bor

Ted

€curve

Good luck....& make sure you're not at the mercy of the tape bomb speculation today.

Lee

Sunday 8 February 2015

New week 08/02/2015

Non farm payroll data surprised to the upside 257k vs 228k expected. US bonds took quite a tumble, dragging Bunds with it kicking and screaming "i don't wanna go down"

Well Bobl ignored this action...Did somebody know something?

Maybe the S&P downgrade of Greece later in the evening had some effect. There is plenty up in the air on the Greek saga, Tsipras sounding stubborn this weekend hasn't calmed the Grexit talk that's for sure.

US Eurodollar and notes/ bonds net change Friday

EU Euribor and German bond futures net change.

US 10 year futures

Well Bobl ignored this action...Did somebody know something?

Maybe the S&P downgrade of Greece later in the evening had some effect. There is plenty up in the air on the Greek saga, Tsipras sounding stubborn this weekend hasn't calmed the Grexit talk that's for sure.

US Eurodollar and notes/ bonds net change Friday

EU Euribor and German bond futures net change.

US 10 year futures

Even before the payrolls data there was a sense that a down move was coming. Momentum to the upside beginning to slow especially with the ECB on Greek Collateral comments Thursday. Appears a very split camp with regards to rate rises at the moment. September rise seems sensible whilst many seem to be considering June. All this while 17 central banks around the world cut rates in the first 5 weeks of 2015. It could be possible that Fed don't even raise this year.

Anyway these are my charts of the 10s. I doubt we'll see continued selling on Monday. Europe will drive proceedings but upside could be restricted.

Bund

Traded heavy Friday after the opening gap higher, the release of NFP encouraged even lower. Not nearly enough to break the long term up trend. Plenty of little areas for chop between 158.40 & 159.10. Probably wise to avoid those as we might be sensitive to squawks all week long as ECB/Greece continue in their stare out competition. There is usually more reward in buying dips than selling up moves, but last week made me think we might be nearing the end of that.

Bobl, As bud loitered around its lows for the week Bobl just wanted to see whats going on around its all time highs!

Mini S&P Nice big range in play on the daily just now.

EuroStoxx

EU6

Back on the heavy trend after the downgrade, just as we were looking for a bounce.

Dec15 Euribor

Dec16 Euribor

Dec17 Euribor.....Why I'm looking at these I'll never know...I guess its like watching the Liffe heart beat turn to flatline :-(

€ curve

€ teds

Friday 6 February 2015

06/02/2015

Good morning all,

After Wednesdays ECB late show on Greek debt the bond markets had every opportunity to go push for new highs. It didn't, so there's a good chance that the upside is a little exhausted. Its Non Farm Friday today so all action will be subdued beforehand, unsettling volatility during and pointlessly dull after.

We may see something interesting from the LTRO release this morning given whats been occurring in Greece but I think we've seen the worst of that theme at least until the Euro gang all meet next week.

Yesterdays Euro stirs & German bond net change.

US stirs & bond net change

US ten year

After Wednesdays ECB late show on Greek debt the bond markets had every opportunity to go push for new highs. It didn't, so there's a good chance that the upside is a little exhausted. Its Non Farm Friday today so all action will be subdued beforehand, unsettling volatility during and pointlessly dull after.

We may see something interesting from the LTRO release this morning given whats been occurring in Greece but I think we've seen the worst of that theme at least until the Euro gang all meet next week.

Yesterdays Euro stirs & German bond net change.

US stirs & bond net change

US ten year

Mini SnP

EU6 cme eurodollar fx future

EuroStoxx

Bund

Bobl

€curve Long term trend for flattening being questioned just now. short term reversal in play but US non farm to dictate today's behaviour. We could just see some range bound stuff till participants start to look towards March and the ECB QE program.

€Ted Watch for LTRO this morning. I think we've seen the worst of capital flight from Greece panic for now which should halt the trend for lower.

Good Luck

Monday 26 January 2015

26/01/2014 After the Greek election

Merkel and Draghi's fears being realised this morning as the people of Greece celebrate a Syriza general election win. I'm still not clear on whether this is outright or as a coalition.

After this bit is settled it'll be all eyes on the Troika, will there be a suspension of assistance? will all get around the table and discuss some kind of compromise? Will this Government's ideas be too unworkable that we see another election come April?

Only time will tell......Needless to say Bunds will carry on its march to 0 yield & curve to flatten, I'd also expect BTP to continues its compression vs bunds after its shaken off this brief Grexit fear.

TYA 240min

30min

Bund 240min

30min

€curve

BTP-Bund

BTP 30min

€ ted

EURUSD future 240min

Stoxx Daily continuous

Mini Snp 240min

We have IFO and Euro retail sales this morning for what its worth. Then we can start looking towards the US for some rates of interest later in the week.

Subscribe to:

Posts (Atom)