Eurogroup meeting today trumps all other news. Schaeuble appears to be pissing on everybody's chips by suggesting that any idea of a quick fix/short term resolution are fantasy. I expect toing and froing of this kind all day from squawks before we get any announcements late on.

US stir/bond net changes for yesterday

In anticipation of the rumoured quick fix and moderately decent data we saw some steepening.

EU stir/bond net changes.

TY,

Bund. After managing to test the 158.32 and breaking we closed back in the middle of range, could be an interesting day. Mid term a down trend is beginning to appear. I still need to see 157.77 broken before I'm convinced of bearish trend in the long term. Intra day risk that yesterdays low break was a falsey and bad news from the Eurogroup could push us back to new high targets. We are in a corridor of uncertainty and anything between 40 and 80 is chop to be treated with caution and tight stops. At the mercy of tape bomb luck.

EU6

Stoxx

Btp-Bund I use as a leading indicator on teds......mildly optimistic looking.....Although QE will trump Grexit on this relationship(eventually)

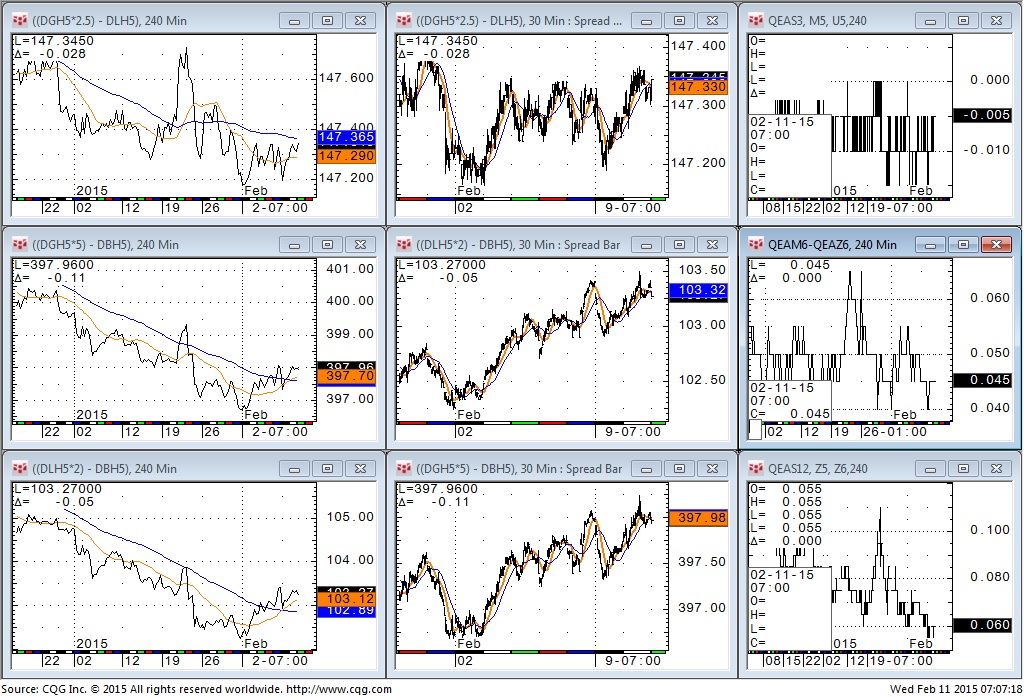

Dec16 Bor

Ted

€curve

Good luck....& make sure you're not at the mercy of the tape bomb speculation today.

Lee

No comments:

Post a Comment