Well that was quite some end to October. Fed taper not off the table this side of Christmas (data dependant) and the Chicago PMI coming in quite a bit higher than expected. Maybe its not all doom and gloom in the USofA.

The other side the UK is a different story altogether. All European data coming out was relatively negative non more so than the CPI. This caused banks everywhere to change their current ECB rate forecasts to include a cut soon. In some instances as soon as next week!

So we get a double whammy for the EURUSD. The EURJPY, EURCHF and EURGBP could see quite a turnaround into year end.

I don't expect the cut to come this week although dovish tones will ring out. So we could get a little retrace of the recent moves into Thursday to enable some real edge on longer term trades.

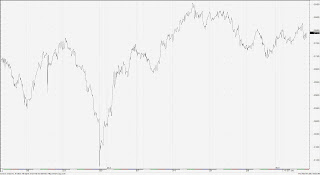

My EURCHF cme futures 30min chart.

Daily

EURUSD cme futures Daily.

-----------------------------------------------------------------------

So how has the rest of 73 charts fared this week?

Well this was a nice little earner after taking the "cheap stop" last week, I had another go this week....and FOMC less dovish comments worked fine and dandy. Octobers down trend came from a lack of desire to own short dated US bonds. Once this was dealt with everyone assumed taper out the window so we witnessed a sharp up move towards the end of the month.

After such a big move down I do anticipate a little sideways and maybe a small retrace. Actually could establish a small range around here until the next meet. That said Non farm and employment on friday will influence a big move, that I can be certain of....Even if I have no clue what way!

-----------------------------------------------------------------------------

I dunno why I play this blighter! When i first started charting it there was a nice size ATR mean reverting range. Since I went live its been one excuse after another for swinging around. I might as well drop it and trade outright 2 year. Far less volatile, just missing that false sense of security I give myself with these ideas. Just keep size small!

--------------------------------------------------------------------------------

This one I love...always keep it small and it contributes to the pot. In one of the hardest markets to trade without flow nod or just blatant front running!. This idea has given me suitable false sense of security.

Cracking week to look forward to for volatility. So keep your powder dry, your size rational and your mind fresh...You do this and your plans should put ticks in your bin.

Blacks keys are on my headphones at the mo....Love the earthy raw stuff. Anyway, Ive just been summoned to make the tea.

Be groovy

Lee