Cpi has been in steady decline for the best part of 2 years. ECB target is 2%, it hasn't been there this year. Last weeks number was quite a dip down from the expected too. So this triggered calls for a rate cut. Some banks even going for one today.

If there is no cut today which I think is largely expected we may see a slight knee jerk sell off in front and red euribor. Given the expectation for a cut in December this would offer a decent buying opportunity. I do expect quite a dovish Q&A from Mr Draghi including hints towards new liquidity measures. So I can only see profit in buying Euribor dips.

€ teds have continued to climb higher, tho I wouldn't rule out some small retrace pre ECB. A non event disappointment Q&A could see these spreads get sold hard initially. I still find more risk to being short, so would consider that an opportunity to buy cheap teds.

€ curve quite some steepening since the Cpi release, huge amounts in Bobl/Bund spread. Schatz/Bobl & Schatz/Bund have made a steady climb higher in line with expectations of shorter rates being cut. On the longer term time frame (240min) they currently sit just under the down trend line. A cut today would see them replicate the Bobl/Bund chart and target much higher levels.

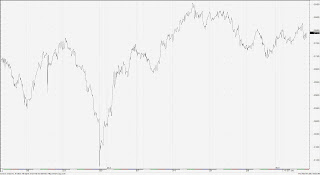

BTP/Bund spread.

Mustn't forget UK has its rate announcement today too. I'll keep an eye on this Gilt/Bund spread

Oh, amidst all this US initial Jobless claims and GDP might throw a curve ball into proceedings.

Good luck

Lee

No comments:

Post a Comment